The Rise and Fall of Lamelo Ball Rookie Cards: A Cautionary Tale

In the world of sports memorabilia, rookie cards hold a special place. They are sought after by collectors and enthusiasts alike, representing the early days of a player’s career and holding the promise of future greatness. However, the recent saga of Lamelo Ball rookie cards serves as a cautionary tale about the volatility of the market and the risks of investing in these prized possessions.

The Plummeting Value

Check out the video on Youtube here.

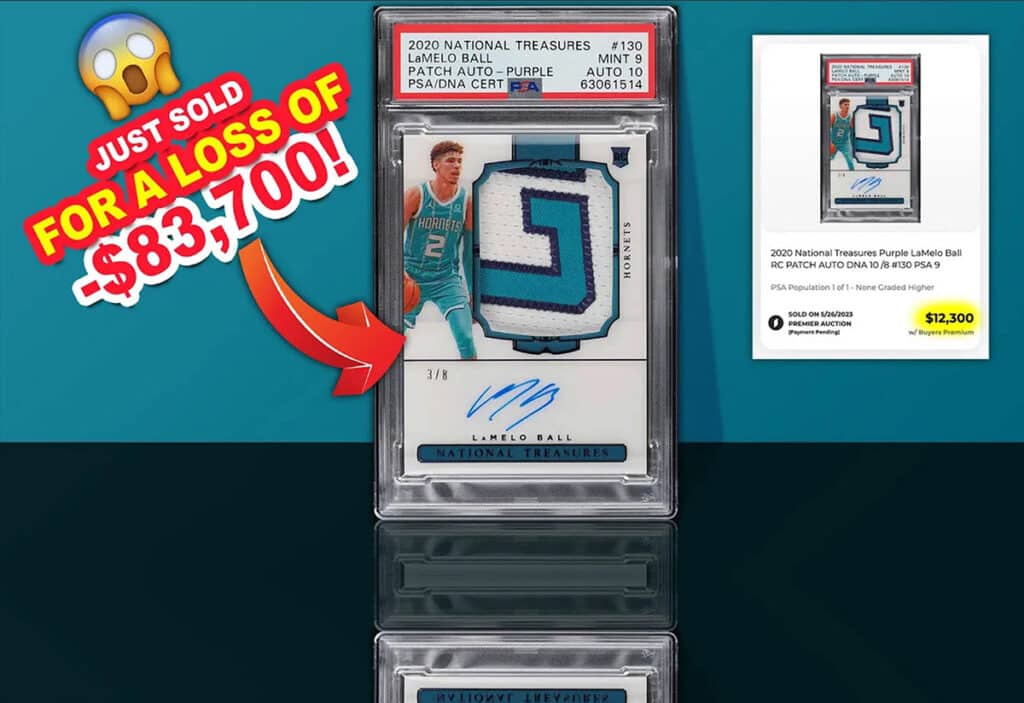

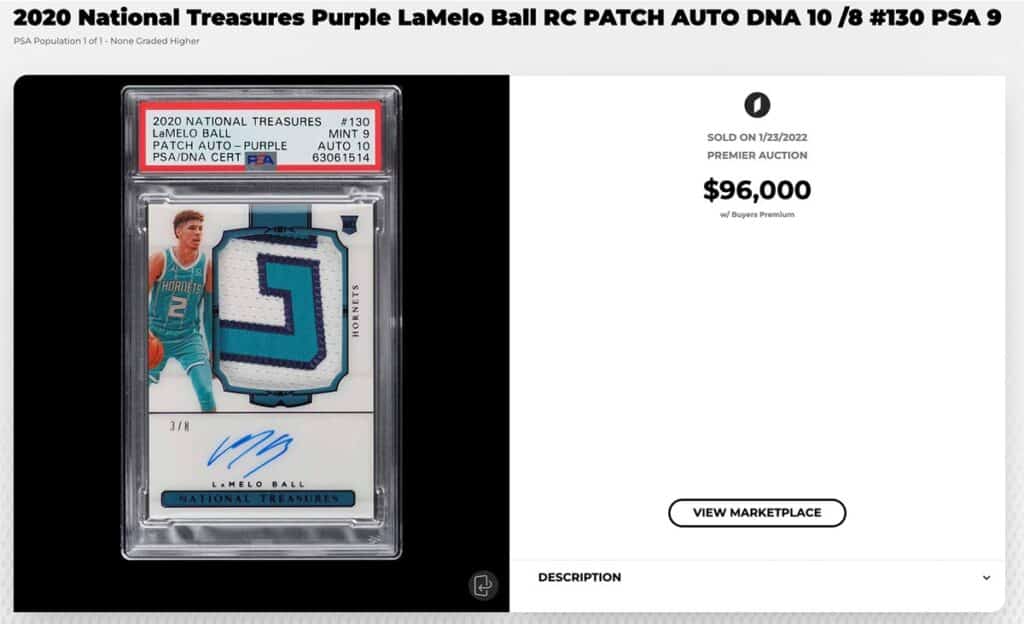

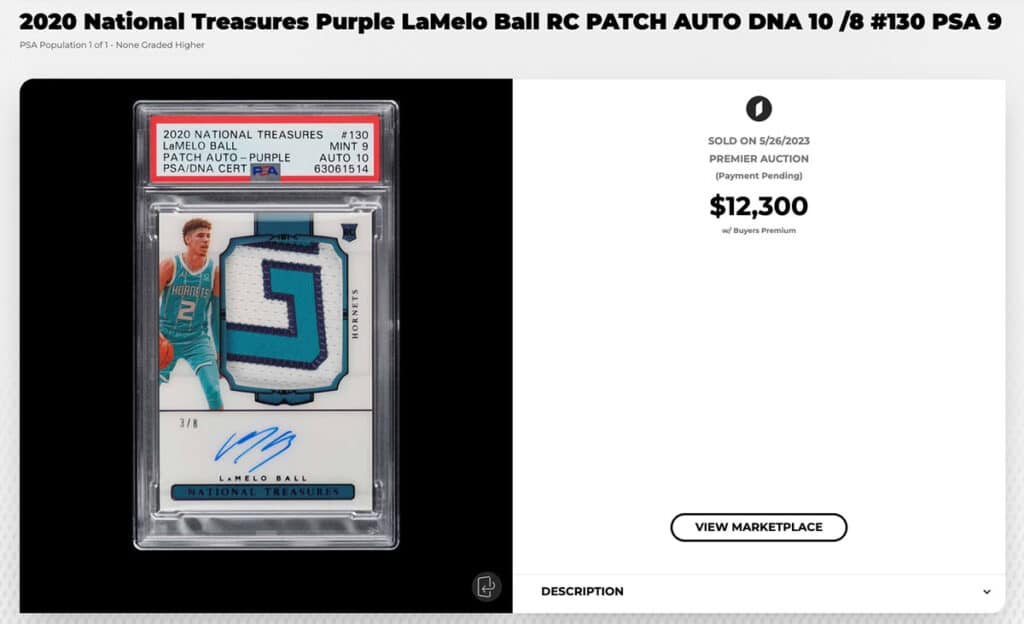

One particular Lamelo Ball rookie card, a 2020 Panini National Treasures purple parallel, recently made headlines for its drastic decline in value. This card, graded PSA 9 with an autographed grade of 10, was initially sold for an astounding $96,000 in January 2022 on PWCC Marketplace.

However, its fate took a dark turn when it resurfaced at an auction on May 26, 2023, ultimately selling for a mere $12,300. This substantial loss of $83,700 left collectors and investors stunned.

The Identity Crisis

What made this card’s story even more intriguing was the revelation that it was not associated with any specific player, game, or event. The enclosed officially licensed material was not definitively linked to Lamelo Ball himself, raising questions about its true value. While Panini guaranteed the autograph, it remained uncertain if this was genuinely a Lamelo Ball patch. The uncertainty surrounding the card’s origins only added fuel to the fire.

Supply, Demand, and the Impact of Limited Editions

One critical factor contributing to the downfall of Lamelo Ball rookie cards was the abundance of limited edition parallels flooding the market. The purple parallel in question was an example of such a highly coveted rarity, being a super short print out of just eight. However, as the market became saturated with similar limited-edition variations, the law of supply and demand began to take its toll. With an oversupply and a limited number of buyers willing to invest in such high-priced cards, the value began to plummet.

The Lamelo Ball Factor

Another significant factor influencing the fate of these cards was Lamelo Ball’s limited playing time. Despite the hype surrounding the young basketball prodigy, his on-court appearances were less frequent than anticipated. This factor diminished the perceived value of his rookie cards, as collectors questioned the long-term potential of an athlete who was not consistently making a significant impact. With fewer opportunities to showcase his skills, the allure of owning a Lamelo Ball rookie card began to wane.

Lessons Learned

The dramatic decline in value of the Lamelo Ball rookie card serves as a stark reminder to collectors and investors alike. It highlights the dangers of relying solely on market trends, comp values, or the influence of popular opinion when making purchasing decisions. The cautionary tale urges individuals to pay close attention to the specific details of a card, its authenticity, and its true scarcity before committing substantial financial resources.

Conclusion

The story of the Lamelo Ball rookie card’s rollercoaster ride in value is a testament to the unpredictability of the sports memorabilia market. It demonstrates that even highly sought-after items can suffer from significant losses if market conditions, player performance, or authenticity questions come into play. Collectors and investors must approach the hobby with due diligence, conducting thorough research, and making informed decisions based on concrete facts rather than speculation or inflated valuations. Only then can they safeguard their investments and mitigate the risks associated with this ever-fluctuating market.

Top 8 Sports Cards to Grab on PWCC Marketplace for Around $100

Top 10 Giannis Antetokounmpo Rookie Cards – Recent Sales

Larry Bird Basketball Card Values & Recent Selling Prices

The Best Anthony Edwards Rookie Cards with Recent Prices

1986 Fleer Michael Jordan Rookie Card Sells for $222,000

2009 National Treasures Steph Curry Rookie Card Sold $144,000

From a young age, Matt dove deep into sports card valuation, turning to esteemed price guides like Beckett and Tuff Stuff. Eventually he extended to Pokémon, Magic: The Gathering, and Yu-Gi-Oh!. With a vision to sustain and nurture the hobby he loved, Matt established the ‘Graded Card Investor’ YouTube channel and website. He aims to foster a healthy community and offer invaluable insights to those entering the world of sports cards and TCGs. His depth of understanding, from the card market’s 2020 pinnacle to its 1990s valleys, is consistently fortified by meticulous research.