Investing in Baseball Cards

Common questions:

- Are baseball cards a good investment?

- What makes baseball cards valuable?

- I’d like to invest in baseball cards. What would you suggest?

- What’s the difference between speculating and investing?

- What causes the prices to increase on baseball cards?

- Are Minor League cards a good baseball card investment?

- What effect does the grade of a card have on price?

- What do you think about investing in Traded or Updated sets?

Are baseball cards a good investment?

All signs say baseball cards are still a very sound investment. Every year, more and more collectors clamor for a finite supply of baseball cards. The demand is increasing, while the supply obviously cannot. In most cases, the money a collector puts into a baseball card will yield a hefty return just by increasing demand. Modern-day rookie cards such as Mike Trout and high-graded Hall of Famer such as Mickey Mantle have seen huge profits these past few years.

What makes baseball cards valuable?

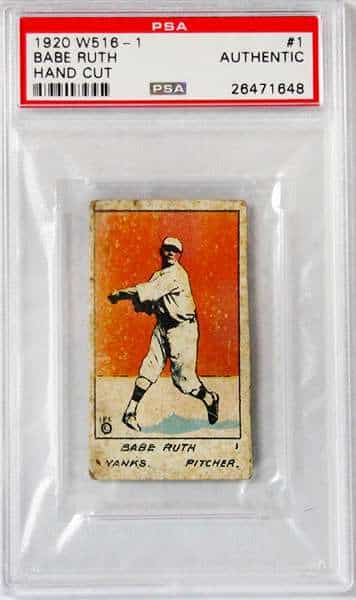

Like all other collectibles, a baseball card’s value is dependent on market demand. A card’s condition, its scarcity, and in some cases, its age are important factors. Outweighing all other considerations, though, is demand. When the chips are down, a card is worth whatever the buyer is willing to spend.

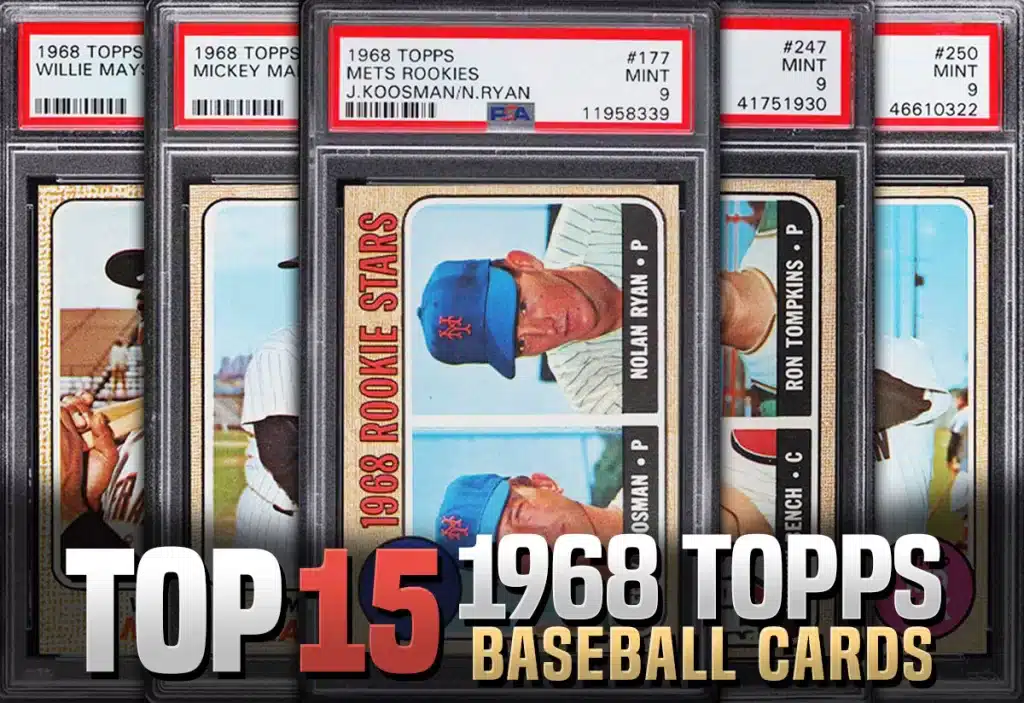

Rookie cards, or the first cards issued for a player that depict him as a major leaguer, are the hottest segment in the hobby today. One reason they are valuable is that collector demand has caused the prices of rookie cards to rise significantly. Collectors buy rookie cards in the same manner that book collectors buy first editions of books. Rookie cards should not be confused with what collectors call “pre-rookie” cards, which are cards of minor league players.

I’d like to invest in baseball cards. What would you suggest?

If you’re interested in investing in baseball cards, you should start learning all about the hobby. It’s not as simple as buying cards, selling them, then cashing them in for your retirement or child’s college education. The business of baseball cards is complex. I suggest you talk to knowledgeable collectors and dealers to get their thoughts on what product or player has the best chance to increase in value. Knowledge of the game of baseball and players can also be of great benefit.

This type of preparation makes sense. If you invest money in the stock market, you wouldn’t pick a random stock, right? You’d either research the companies or seek the advice of a stockbroker on which stocks to buy. You’d also find out how the stock market works. Investing in baseball cards is not that different than investing in the stock market.

Don’t forget that any investment “advice” you receive, no matter the source (including this article), is just opinions, not hard and fast rules. If you plan on investing in baseball cards, I suggest following the steps outlined in the opening paragraph. Then make your own decisions on investment plans.

What cards do you expect to go up in value over the next few years?

What cards you should invest in today is a complicated question because the baseball card market changes daily. Specific baseball card investment advice is out of the scope of this article.

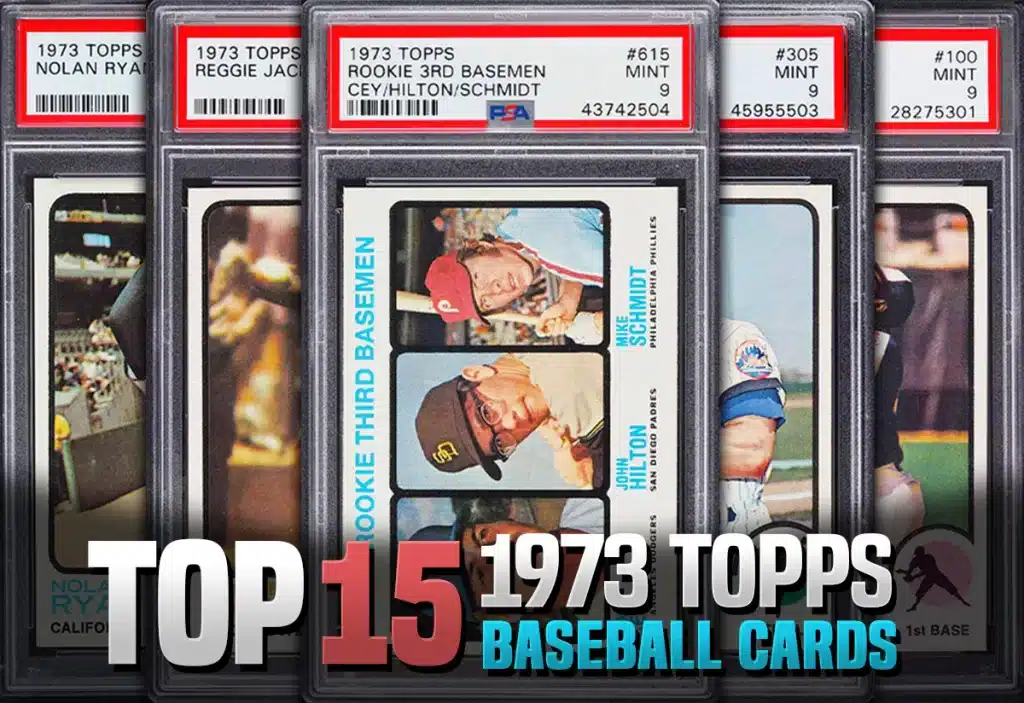

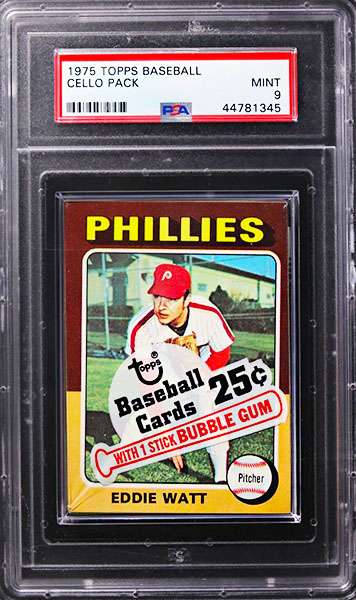

I can offer a general guideline on cards that have proven solid investments for decades and which I expect to continue rising in the future. They include tobacco and candy cards, top-graded complete sets from the 1930s through 1980, top graded rookie and superstars before 1980, and unopened material such as wax, rack, and cello boxes and cases.

This list includes an enormous amount of material, and some items are better investments than others. With this large amount of material and an ever-changing market, the successful baseball card investor does his homework and stays attuned to the trends in the hobby.

What’s the difference between investing and speculating on baseball cards?

The difference is putting money into a proven commodity (investment) versus an unproven commodity (speculation). Generally, the newer the cards, the bigger the speculation. Conversely, the older the cards, the better the investment. The reason behind this is supply and demand. Companies printed fewer cards before 1980 than were printed after 1980. Also, relatively few pre-1980 cards remain in top grade (near mint or better condition). While there are thousands of cards and sets after 1980 in top grade.

Simply put, buying a 1970 Topps set in near-mint condition is a terrific baseball card investment while buying 100 cards of the newest hottest rookie on the market is speculation. Speculation is a risky proposition when investing in baseball cards.

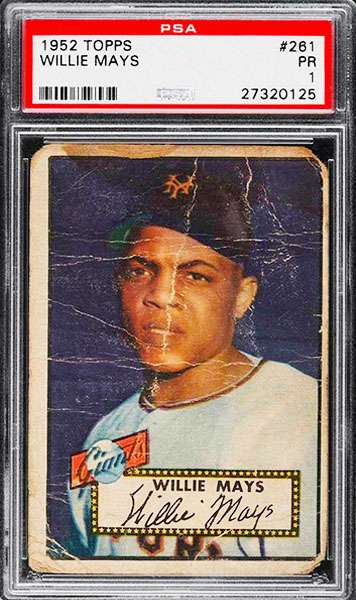

For example, Bryce Harper was ranked as the number one prospect out of high school in 2009 and had massive hype around his rookie cards. In March of 2018, a 2011 Bowman Chrome Bryce Harper rookie card autograph, graded PSA 10, sold for $1,550. At the same time, in 2018, a Willie Mays 1952 Topps rookie graded PSA 1 sold for $475.

In today’s market, the exact Bryce Harper rookie card autograph graded PSA 10 sells for around $1,800, while a 1952 Topps Willie Mays rookie, graded PSA 1, sells for $3,555. If the collector that purchased the Bryce Harper rookie for $1,550 spent that on three Willie Mays ‘52 Topps, he would have profited $9,115 instead of the meager $250.

As a novice in baseball cards, my biggest curiosity is this. As the hobby grows and many young and older people buy complete sets each year, what causes even the recent years’ cards to increase in value at the surprising rate I have seen? Can I expect this to continue as more and more cards are printed, apparently with no limits?

Like any other collectible, baseball cards’ value depends on supply and demand. Much of the current upward price movement in recent (2011 – present) cards reflects anticipation rather than the current market value. Collectors and investors are speculating on hyped stars and rookie cards with the expectation that when they try to sell, the increased number of collectors they believe will be on the market will have created a demand for those cards.

There is a significant potential problem with that theory—currently, Topps prints at least two million of its standard baseball card sets. Yet, there are more than likely fewer than two million people who could be classified as serious enough collectors that they would pay more than the retail pack price for a baseball card. If we assume that the collector is the ultimate customer for all these cards now held by investors and speculators, there will be a real shortage of real customers.

Healthy economic conditions

The economic conditions in this country are pretty good, and there is a lot of disposable income around to invest in baseball cards. If the economy were to take a downturn, however, as happened in 2008, we might see a lot of recent cards being dumped on the market at a fraction of their current value. In short, investing in baseball cards can be just as risky as buying penny stocks.

Are Minor League cards a good baseball card investment?

Again, similar to major league cards, companies printed fewer minor league cards before 1985 than after. Older minor league sets that contain superstar players like the 1981 Pawtucket set with Wade Boggs could hold their value in the long run. As for the more recent sets, their future is only speculative now. However, the strength of this hobby segment is growing, with more than a dozen companies producing minor league cards.

What effect do card grades have on investing in cards? What kind of card grade should I be looking at for getting the most for my investment dollar?

History has shown that the value of top-grade cards has increased in the hobby. Therefore top-grade cards are a must for investors.

Specifically, if you’re buying cards from 1980-present, don’t settle for any cards in less than mint condition. With cards from the 1970s, stay in near-mint condition or better. With cards before 1970, the lowest grade you’d want is excellent to excellent-mint; near-mint is better, and mint better still (though challenging to locate).

One piece of advice – don’t make any major purchase until you know how to properly grade cards. To an untrained eye, a near-mint and excellent card may look the same. Though, in reality, they can be tens, hundred,s or even thousands of dollars apart.

What do you think about investing in Traded or Updated sets?

These post-season sets have proven to be very popular with collectors since Topps introduced them in 1981. And with few exceptions, all have appreciated nicely in value over the years. One reason is that the sets contain many “first cards” of players, such as the 1983 Topps Traded Darryl Strawberry. Another reason these sets are in demand because they are produced in lesser numbers than the regular sets. Demand and a lesser quantity have made these sets a good investment and we can expect their popularity to continue.

Conclusion

Investing in baseball cards can be very profitable as long as you do your research and invest in what has proven to work in the past. Speculating on prospects and rookies can be fun and profitable, however it has much more risk involved. A good rule to follow is 80% Hall of Famers and 20% prospects. This way your collection is more likely to hold value and not disappear if the prospect you spend all of your money on gets injured or stops playing well. Remember to do your research and have fun. This is a hobby after all.

From a young age, Matt dove deep into sports card valuation, turning to esteemed price guides like Beckett and Tuff Stuff. Eventually he extended to Pokémon, Magic: The Gathering, and Yu-Gi-Oh!. With a vision to sustain and nurture the hobby he loved, Matt established the ‘Graded Card Investor’ YouTube channel and website. He aims to foster a healthy community and offer invaluable insights to those entering the world of sports cards and TCGs. His depth of understanding, from the card market’s 2020 pinnacle to its 1990s valleys, is consistently fortified by meticulous research.