Introduction

Over the years, the world has witnessed numerous investment fads, from the dot-com bubble to cryptocurrency. The latest to join this list? Sports card investing! Many are now comparing it to the stock market. But why is there such a buzz about it? Let’s delve deep.

The Rise of Sports Card Investing

Collecting sports cards used to be a cherished childhood hobby, reminiscent of afternoons trading cards with friends.

Understanding and Investing in Sports Cards:

- The sports card investment market involves purchasing officially licensed sets and brands, such as those by Topps (MLB), Panini (NBA, NFL, UFC, and soccer), and Upper Deck (NHL). Notably, different sports leagues grant their official licenses to these manufacturers.

- It’s vital to comprehend the difference between card sets, which are released throughout the year, and focus on investing in ones with a solid track record and popularity among collectors.

- Different card types include base cards, photo variations, parallels, refractors, rookie cards, and cards with player jersey patches. Cards’ value is influenced by rarity, player popularity, and condition.

Brief history of sports card collecting

The first sports cards were baseball cards, introduced in the late 1800s as a promotional item in tobacco products. Fast forward to the 1990s, when the card industry boomed but subsequently faced saturation and declined.

The transition from hobby to investment

What changed? The internet. Online platforms gave collectors a broader audience, converting casual enthusiasts into serious investors eyeing lucrative returns.

Comparing Sports Cards to Stocks

Sports cards and stocks seem poles apart, but parallels are closer than you’d think.

Tangible vs intangible assets

While stocks represent a share in a company, sports cards are tangible assets. They can be held, showcased, and enjoyed – an aspect stocks can’t match.

Volatility and risks

Both markets experience volatility. Card values can swing based on player performance, while stocks dance to the tunes of market dynamics.

Return on investment

Historically, blue-chip stocks offered stable returns. Similarly, cards of legendary athletes have shown consistent value appreciation.

Why Sports Card Investing is the New Stock Market!

The momentum around sports card investing is undeniable.

Market trends and data

Recent data suggests a surge in card prices, some even fetching millions at auctions, akin to high-performing stocks.

The new wave of investors

Millennials, attracted by nostalgia and potential returns, are diving headfirst into card investing.

Role of celebrities and influencers

Stars like Gary Vee are endorsing sportscard investing, adding fuel to its booming popularity.

How to Get Started with Sports Card Investing

Dipping your toes into card investing? Here’s your guide.

Purchasing Strategies and Platforms:

- Platforms like eBay are important in the sports card space, offering various options and a large market to buy and sell sports cards and sealed wax. Knowledge of recent sale prices and card trends is pivotal for making sound investment decisions.

- Local card shops and card shows provide opportunities to buy cards, with an emphasis on negotiation and understanding card price history.

- Online card breaking is a collaborative and entertaining method to possibly obtain high-value cards, involving purchasing parts of a box which is then opened live online.

Researching valuable cards

Start with well-known athletes, but don’t shy from rookies showing promise. Their cards might be the next big thing. Here are some good places to start:

Understanding grading and authenticity

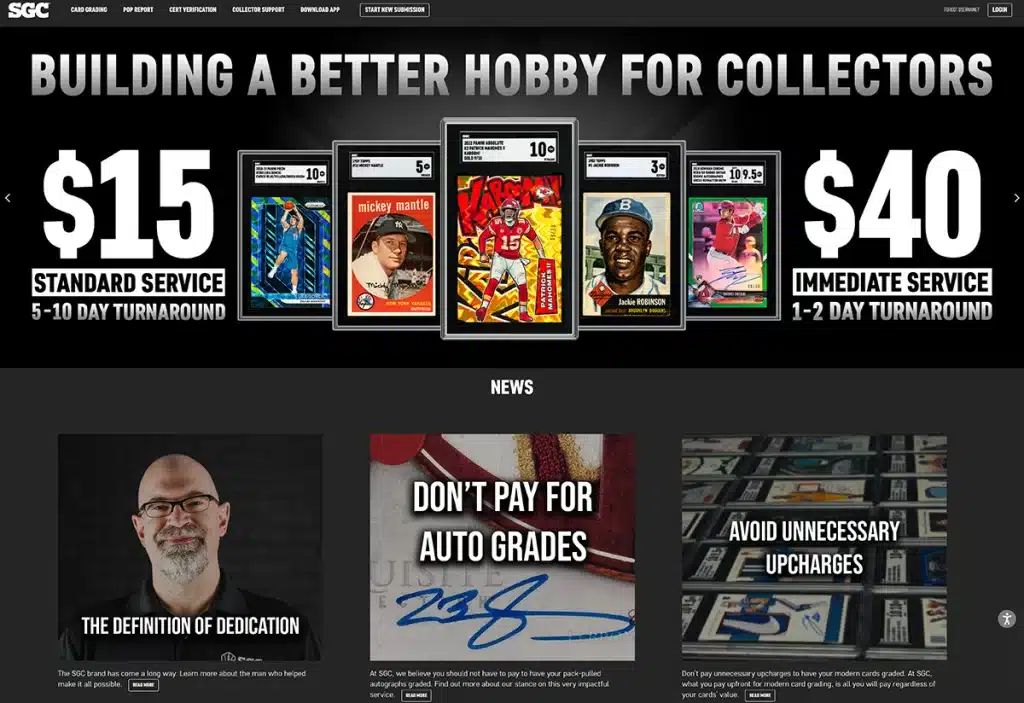

A card’s value hinges on its condition. Grading companies can assess and authenticate your cards, ensuring their value. The four main grading companies right now are PSA, BGS, SGC, and CSG. Here is a comprehensive overview of each company.

Card Grading Nuances:

- Card grading companies, such as PSA and BGS, evaluate cards based on various aspects, including corners, edges, centering, and surface quality, assigning them a grade that significantly impacts their market value.

- Various grading companies employ different scales and definitions for their grading, which can affect the perceived and actual value of cards in the secondary market.

- Familiarity with the grading scale, the meaning of different grades, and understanding the price ratio between different grades enhances investment strategy and card valuation.

Navigating auctions and sales platforms

Websites like eBay are goldmines for trading cards. But, attending physical auctions can offer rare finds and less competition. Other auction houses to look into are PWCC Auctions, Heritage Auctions, and Goldin Auctions.

Card Authenticity and Integrity:

- The sports card market is not immune to the challenges of counterfeit and altered cards, so the integrity of cards and their grading is paramount.

- Utilizing the serial number or certification number on graded cards to verify their grading and validity through respective grading companies’ databases ensures investment security.

- Recognizing the impact of card condition on value, and understanding the rarity of perfect grades aids in optimizing investment and ensuring purchases are justified and promising.

Pros and Cons of Sports Card Investing

Every investment has its ups and downs, and cards are no exception.

Potential high returns

Rare cards can fetch astronomical prices, offering lucrative returns.

Unique and rare finds

Hunting for unique cards can be a thrilling experience, akin to treasure hunting.

Investing in Sealed Products:

- Sealed wax, or unopened boxes of cards, can be a lucrative investment if kept sealed and resold in the future due to the potential for valuable cards inside.

- Knowledge about different types of boxes and products, such as retail versions from stores like Walmart and Target, as well as hobby boxes, is crucial for informed investment.

- Although opening boxes can be enjoyable, it is generally recommended to keep boxes sealed for investment purposes to potentially maximize future value.

Risks and market saturation

Like any market, saturation is a concern. Ensure to have a diversified portfolio in order to mitigate risks. If you need to liquidate and sell check out our article on how to sell sports cards.

The Future of Sports Card Investing

Where is this market headed?

Predictions for the market

Experts predict steady growth but advise caution and thorough research. Furthermore, it is advisable to collect and invest in what players, sets, and brands you like.

Emerging niches within the hobby

Beyond traditional sports, cards from eSports and other niches are gaining traction. Pokemon cards and other TCG categories are also gaining momentum.

Digital cards and NFTs

The digital revolution isn’t sparing cards. NFTs are becoming the digital equivalent of physical cards.

FAQs

- What determines a sports card’s value? The card’s rarity, condition, player’s reputation, and market demand play pivotal roles in determining its value.

- How do I ensure my card is authentic? Get it graded by reputable companies like PSA or Beckett to ensure authenticity.

- Is it too late to start investing in sports cards? Not at all! While the market is booming, opportunities abound with the right research.

- Can digital cards be a good investment? Digital cards, especially NFTs, are gaining ground. They can be a future-forward investment, but ensure thorough understanding before diving in.

- Are sports cards a liquid investment? Sports cards can be liquidated easily through online platforms or auctions, making them relatively liquid assets.

- How does market saturation impact card values? Oversaturation can depress card prices. However, rare and vintage cards usually maintain or appreciate in value.

Conclusion

The comparison of sports card investing to the stock market isn’t far-fetched. With the right strategies, research, and a dash of passion, this domain offers myriad opportunities. As with all investments, risks are present, but the thrill of hunting rare cards and the potential for high returns make it an enticing venture for many.

To stay up-to-date on sports card values, follow Graded Card Investor on YouTube.

From a young age, Matt dove deep into sports card valuation, turning to esteemed price guides like Beckett and Tuff Stuff. Eventually he extended to Pokémon, Magic: The Gathering, and Yu-Gi-Oh!. With a vision to sustain and nurture the hobby he loved, Matt established the ‘Graded Card Investor’ YouTube channel and website. He aims to foster a healthy community and offer invaluable insights to those entering the world of sports cards and TCGs. His depth of understanding, from the card market’s 2020 pinnacle to its 1990s valleys, is consistently fortified by meticulous research.