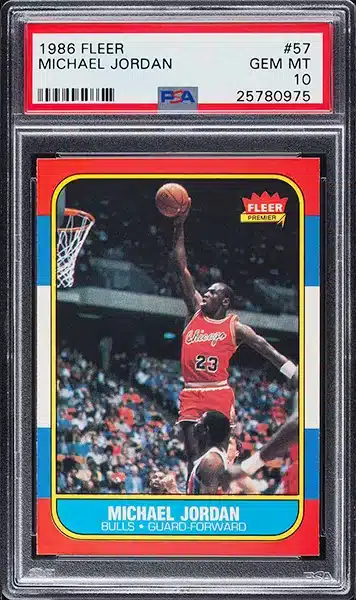

Michael Jordan’s 1986 Fleer RC

The 1986 Fleer Michael Jordan Rookie Card has been a beacon in the sports card collecting world, particularly for graded card investors. Notably, the value of a PSA 10 graded card has seen a rollercoaster ride from approximately $30,000 in late 2019 to a peak of $840,000 in July 2021, followed by a dip to $168,000, and a recent rise to $222,000 as of November 2023. This article delves into the fluctuating values of this iconic card, offering insights for investors.

Market Dynamics:

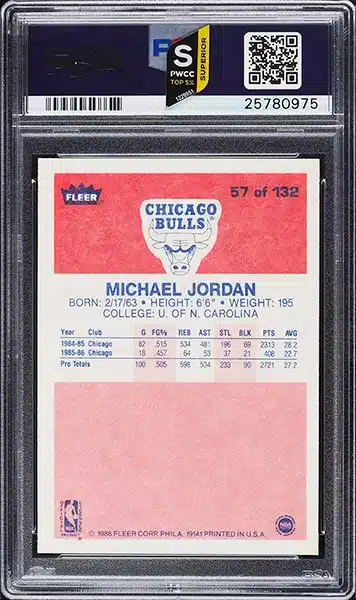

The journey of the 1986 Fleer Michael Jordan Rookie Card #57 in PSA 10 condition highlights the volatile nature of the sports card market. PSA has graded 26,023 of the ’86 Fleer Jordan RC, with only 321 achieving the Gem Mint 10 status. This scarcity, combined with Jordan’s legendary status in basketball, creates a perfect storm for value fluctuations.

➡️ Compare the Value of the ’86 Fleer Jordan RC on eBay

Recent Sales and Trends:

- Record Peak: $840,000 (July 2021)

- Apparent Bottom: $168,000 (2022)

- Recent Resurgence: $222,000 (November 2023) Sold by PWCC Auction

This trend suggests a market correction post-COVID-19 sports card boom, possibly stabilizing at the new bottom. The card’s value reflects both the sports card market’s health and Michael Jordan’s enduring legacy.

Insight for Investors:

For graded sports card investors, the 1986 Fleer Michael Jordan rookie card remains a cornerstone. The card’s highest valuation at $840,000 shows its peak investment potential, while its fluctuations offer opportunities for strategic buying and selling.

- Card Significance: The 1986 Fleer Jordan Rookie card is one of the most legendary cards in the market, akin to the Wagner and Mantle cards. It captures a piece of Jordan’s legacy and is a sought-after collectible.

- Fleer’s 1986 Set: The set was released in September 1986 under a licensing deal with the NBA, featuring 132 cards and 11 stickers. The packs, sold for 40 cents each, contained some of the game’s best players, making the set highly coveted.

- ROI on Jordan’s Rookie Card: Initially affordable, the packs offered a good chance of obtaining a Jordan rookie. The significant rise in value, with a PSA 10 example reaching $738,000 in 2021, highlights its investment potential.

- Preference Factors for Collectors: Collectors prioritize licensed cards, brand names, and card quality. The 1986 Fleer Jordan card meets these criteria, outperforming other Jordan cards from the era in value.

Additional Information:

- Photo Selection and Origin: The card’s photo, capturing Jordan’s trademark dunk, originates from his rookie season (1984-85), not 1986. It’s a snapshot from one of the Bulls’ away games against the Nets, making it historically significant.

- Photographer and Photo Timing: The photo, possibly taken by Noren Trotman (not confirmed by Fleer), was captured between October 27, 1984, and April 21, 1985. This timing predates the card’s release by at least 17 months, adding to its uniqueness.

- Investment Appeal: Owning this card is akin to holding a piece of basketball history. Its popularity and Jordan’s fame make it a potentially lucrative investment, with values fluctuating based on market trends.

🔥 30 Best Michael Jordan Basketball Cards In-Depth Guide & Values

Final Thoughts

The 1986 Fleer Michael Jordan Rookie Card continues to be a significant piece for graded card investors. The card’s value trajectory from pre-COVID levels to the peak and its subsequent adjustments provide valuable lessons in market dynamics. As the market settles, this card remains a blue-chip asset, exemplifying the potential of sports card investing.

From a young age, Matt dove deep into sports card valuation, turning to esteemed price guides like Beckett and Tuff Stuff. Eventually he extended to Pokémon, Magic: The Gathering, and Yu-Gi-Oh!. With a vision to sustain and nurture the hobby he loved, Matt established the ‘Graded Card Investor’ YouTube channel and website. He aims to foster a healthy community and offer invaluable insights to those entering the world of sports cards and TCGs. His depth of understanding, from the card market’s 2020 pinnacle to its 1990s valleys, is consistently fortified by meticulous research.